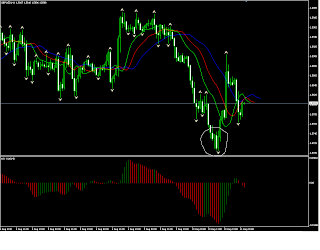

A bearish divergent bar with divergence in AO and price, enter Sell @1.5963 (one tick below BDB low)

Protective Stop Loss @ 1.6001 (one tick above BDB high) ----> trailing stop, move to 1.5998

2nd Trade

Above is my open position from last week trading. As for today, it nearly hit my stop loss but then the price went down again and break the down fractal, so i add position, Sell @ 1.5950, protective stop loss @ 1.5998

Price rebound near 38.2 fibonacci and with a long tail like that, i think i should be careful. So i decided to take some of the profit from one of my position @ 1.5950. Total profit would be 1.5963 - 1.5950 = 13 pips. I still hold my Sell position @ 1.5950 though..

3rd Trade

Break down fractal, add position, Sell @ 1.5931

Decided to close one of my position @ 1.5900, no reason why, no exit signal, shouldn't have done that, but it's 00:30, need to have some sleep now, need to wake up early in the morning, so i think i'll just take some profit just in case something happen while i'm asleep. Well we'll se what happen tomorrow. Total profit 1.5950 - 1.5900 = 50 pips. Still hold one position though, and 2 euro/usd position.

Should've waited until the price close above the red line, but i got something to do today, won't be able to monitor my position. So better take the profit, close 1.5931 position @ 1.5829, total profit would be 1.5931 - 1.5829 = 102 pips.

Tuesday, 10/8/2010, 16:49 (4th Trade)

Price continue to go down. Break another down fractal, Sell @1.5776 with protective Stop Loss @ 1.5830.... Just follow the trend, we'll see...

Tuesday, 10/8/2010, 18:39

Close my 1.5776 position @ 1.5756, total profit is 20 pips. No exit signal yet, but 15 min chart show an AO divergence and the momentum getting weak so i decide to close the trade, like usual i like to play it safe, maybe next time i try to follow the trend a lil bit more hehe : )

|

| 15 min Chart |

Wednesday, 11/08/2010, 10:12

This is after I close my last position...

Wednesday, 11/08/2010, 18:00 (5th Trade)

a Bullish divergent bar, buy @ 1.5699 (one tick above bdb high)

put protective Stop Loss @ 1.5665 (one tick below bdb low)

Wednesday, 11/08/2010, 21:00 (6th Trade)

My stop loss got hit @ 1.5665, total loss = 34 pips : (

Try to stop and reserve now, now i'm in sell position @ 1.5665, we'll see how it goes..

Wednesday, 11/08/2010, 23:36

AO divergence, long tail tells us there's a buying pressure, maybe it's time for correction, 15 min & 30 min chart momentum also decreasing, so i decide to close my 1.5665 position @ 1.5684, play it safe : ) still down trend though. Total loss is 19 pips.

No comments:

Post a Comment